Because of this you are going to confer with your financial before determining your wanted possessions

10 de diciembre de 2024A traditional Name Mortgage demands one to pay a fixed number every month having a flat time period (age

10 de diciembre de 2024House equity mortgage

A house security financing is a kind of mortgage in which you employ new security in your home locate that loan. The attention rates away from a property equity financing are often highest. Someone purchase household equity money for several intentions, such as toward upgrade of the land, debt consolidation reduction, etc.

For this, you must learn the property value new collateral against which you can borrow cash. Every lenders want 15 to 20% regarding collateral built up at home to give you a home collateral mortgage.

There clearly was a very easy technique to estimate our home guarantee of your property. It could be calculated by the deducting the loan harmony from the worth of our house.

What is actually HELOC?

HELOC is actually a line of credit you to properties much like an excellent bank card. You can withdraw any amount of cash we wish to, and your attract could be varying in cases like this; that is, http://www.availableloan.net/installment-loans-tx/los-angeles/ it will vary occasionally.

If you buy property guarantee loan, then it can help you in a variety of ways, like the currency you have made regarding mortgage are going to be familiar with shell out large expense otherwise big costs. It’s also regularly redesign your house, which can only help when you look at the enhancing the overall value of new

It is because, contained in this loan, your home serves as security to offer the mortgage, which is different from other kinds of fund where most other property are used since security.

In a home security financing, your residence will act as the latest guarantee towards loan. If, regardless, the new borrower doesn’t spend their month-to-month instalment or is unable to spend their month-to-month instalment, then the financial will get foreclose his home. Very, it would be a major loss into the borrower, additionally the biggest resource off their lifestyle could be destroyed.

It is an accountable activity in which you need certainly to pay-off the fresh lent amount also the recharged amount of desire.

The interest rate of family collateral money and you can HELOCs is generally less than compared to other sorts of loans, such as signature loans, nevertheless prices may possibly not be fixed.

Additionally hinges on industry conditions; which is, in case your worth of your house increases, then the property value your own equity will increase and you may vice versa.

When you take property collateral mortgage, your home is with the address. Unless you pay the borrowed funds on time, your house tends to be foreclosed.

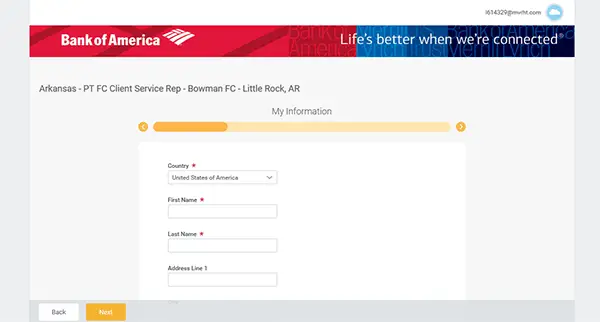

Applying for home guarantee and HELOC

Once you have determined that you like to track down a home guarantee loan otherwise a great HELOC, the initial step is to obtain a lender. The brand new debtor should look at several lenders and compare the eye cost and their costs.

You must complete the applying in which some documents are essential. Together with, you have got to complete the borrowing from the bank, household well worth, etcetera. This action is really much like the process followed through the taking any other type regarding financing.

You don’t need doing far once you’ve occupied from application to suit your financing. The lender is certainly going through your files and you will examine them to determine whether your be eligible for the mortgage or otherwise not.

Alternatives to using house equity

A great revert home loan is even a variety of loan that’s designed for dated somebody, generally of one’s ages of 62 ages or higher. Just like a home security mortgage, capable play with their property security since equity to track down a beneficial mortgage. But unlike security, brand new borrower shouldn’t have to afford the loan instalments all of the month; rather, the complete count try paid back if the home is marketed otherwise this new borrower actions to some other put or passes away.