Concernant le citoyen amoureux, la passion represente semblablement tout mon drogue

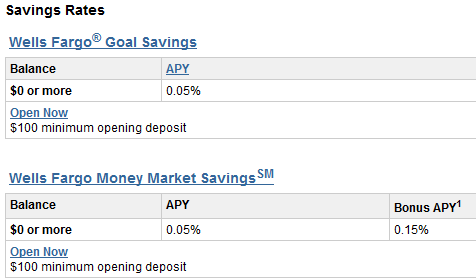

8 de enero de 2025Bad Information: «Search for Financial Rates» rather than stating Whenever

8 de enero de 2025Could you be considering taking one huge step to your homeownership inside Brand new Mexico? Strengthening guarantee, enjoying tax gurus, function off roots into the a residential district, and customizing a house into the own preferences are just good several benefits of owning a home.

In this Self-help guide to To order a home having Teenagers & First-Big date Homeowners, we’re going to provide you with the advice that you should updates yourself to have a successful first faltering step onto the homeownership ladder. We’re going to supply email address to possess skilled financial experts who is actually able and able to answer any queries you may have because you prepare yourself becoming a primary-big date homebuyer within the The new Mexico.

Evaluate Your existing Economic climate

So you’re able to chart a course pass, you should know your local area now. Have a look at your current finances towards following measures and you may equipment to determine your financial maturity for purchasing a property:

- Have a look at Earnings and you may Jobs Balance: A reliable revenue stream is important in order to managing the lingering will set you back away from a month-to-month home loan, possessions taxes, insurance rates, and you will family solutions and you can advancements. Think how secure your existing a position situation is actually and attempt to assess coming installment loans in Wyoming money along with your most recent manager as well as in your current occupation.

- Dictate an expense Part: Use this simple budget calculation to decide an affordable price part for an in home upon your own household’s month-to-month collect-pay while the month-to-month home PITI (prominent, notice, taxation, and you will insurance policies) commission and other costs.

- Shore Up Coupons: Make sure to has actually a wet-date money just after your own downpayment, closing costs, and you will moving prices are taken into account. Immediately after computed, Cutting edge suggests saving three to six weeks from costs to cover issues.

- Score Pre-Eligible to a home loan: An excellent pre-qualification having a home loan creates useful skills for the homes value and you can their borrowing from the bank limits. Consult with your financial institution otherwise label a great Del Norte Borrowing from the bank Relationship (DNCU) financial administrator now at (505) 455-5228 to possess a no cost financial pre-certification.

Understand the Procedure and Options

The process of buying a property is very daunting in order to earliest-date homebuyers. Getting knowledgeable and you will told with the very first-go out real estate usually encourage that generate told and you will sensible choices before you go getting your first household:

- Learn financial solutions and you can terms and conditions. The consumer Monetary Shelter Agency (CFPB), a proper site of your own You authorities, brings a helpful list of terms per mortgages.

- Score qualified advice out of provide such as homebuyer meetings, discussion board teams towards Reddit and you can Myspace, otherwise economic advisers. Come across a certified mentor online via the National Associated out of Private Economic Advisors (NAPFA).

- System with homeowners situated in, or alongside, your own expected neighborhood preference. Family relations, household members, while some with completed household sales of one’s own can also be provide understanding on the exposure to to invest in household, show resources, making advice.

- Check out the benefits of playing with a cards connection such as for instance Del Norte Borrowing from the bank Union when selecting very first homepetitive pricing, transparent conditions, and you may regional systems are hallmarks from local financial cooperatives and certainly will serve as an ideal financing lover to own mortgages.

Build Actionable Alter to ready Oneself

Just after making a full investigations of the financial predicament, you’re capable of making particular alter to arrange oneself for the earliest home get. Credit ratings, spend raises, and you will debt cures are some key elements into the position oneself to own beneficial terminology on your very first mortgage loan.

Enhancing your Credit rating

Although many credit rating improvements require uniform work over an extended time frame, there are numerous immediate methods as possible get today to help you change your possibility of a favorable credit rating: