Accordingly, the latest Panel approved a restriction when you look at the 1976 ruling owed-on-marketing clauses

30 de diciembre de 2024Annorlunda tjanster har annorlunda styrkor och riktar sig till annorlunda publiker

30 de diciembre de 2024Smith Economic founder and you may chief executive Stephen Smith said the blend of these two loan providers is characterized by a strong social complement and you will subservient strengths. Photos of the Peter J. Thompson/Financial Blog post

Article content

Smith Monetary Corp. was combining a couple of their profile organizations when you look at the a change they says can establish a respected option bank for the Canada.

Smith Financial agreements beefed up choice financial which have Domestic Believe-Fairstone Lender merger Back again to video

The latest advised mixture of Fairstone Bank away from Canada, hence centers on individual financing, that have home loan-centered Household Faith Coes immediately following Smith Economic closed the purchase of the second last year.

- Exclusive blogs out of Barbara Shecter, Joe O’Connor, Gabriel Friedman, while others.

- Day-after-day articles of Economic Moments, this new planet’s best worldwide providers publication.

- Limitless on the web accessibility comprehend blogs away from Economic Article, Federal Article and you will 15 development internet across the Canada having you to membership.

- Federal Blog post ePaper, an electronic digital imitation of your printing release to gain access to on the one tool, share and comment on.

- Personal content out of Barbara Shecter, Joe O’Connor, Gabriel Friedman while others.

- Every day stuff regarding Monetary Moments, the fresh planet’s leading globally company guide.

- Limitless on line accessibility realize posts regarding Monetary Article, Federal Post and you will fifteen information sites across the Canada that have you to definitely membership.

- Federal Article ePaper, a digital simulation of your printing edition to get into into the people tool, display and you will comment on.

Check in otherwise Manage a merchant account

The mixture would carry out a stronger capital feet and also do synergies for the parts like exposure government and you will selling, told you Smith Financial inventor and you will leader Stephen Smith.

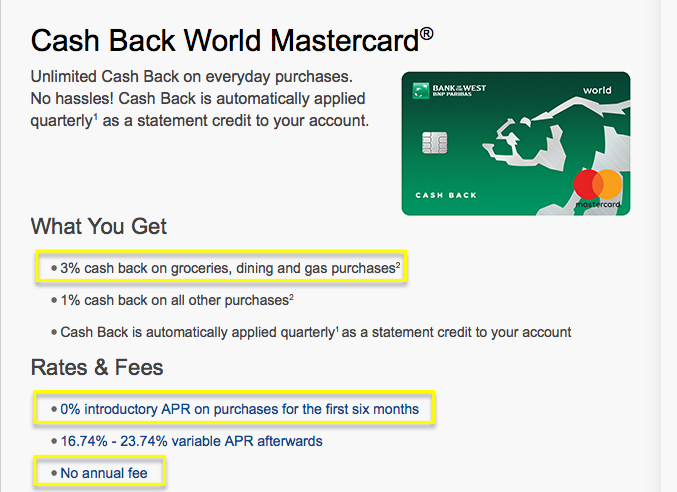

Fairstone Lender also offers playing cards and you will benefits apps, point-of-profit capital, automotive loans and personal financing, whenever you are Home Believe concerns home-based and you may low-residential mortgages, credit cards and you can secured funding licenses.

The contrary lenders often suffice users exactly who find it very difficult to safer loans of more conventional provide eg banking companies, whether it’s on account of loans Conning Towers Nautilus Park CT a dismal credit score, quicker foreseeable income, otherwise they might be novices to help you Canada.

Underneath the contract, Smith Financial will own many share from the this new company, whenever you are Fairstone Bank’s most other investors – Centerbridge Lovers LP, Ontario Teachers’ Pension plan Panel and you may government – continues as minority customers.

The newest shared organization would probably remain both the latest Fairstone or Family Trust label, but it’s not even decided, told you Smith.

Enhanced strain

The offer happens once the individuals are demonstrating improved filters off large interest rates, however, managers on both Fairstone and you can Household Faith define it more of an effective normalization out-of credit with however strong repayments.

We come across a highly, very good dedication to pay back loans from the Canadians, told you Yousry Bissada, chairman and you will leader off Household Faith.

He said that however some can be compelled to sell, consumers mostly have sufficient collateral in their house to include an effective boundary.

Very while they might possibly be in the arrears, there are plenty of chance for them to promote and then have away from it in the place of penalty in it or even all of us.

Lenders told you also seeing large demand as the banks tighten upwards its borrowing standards, consequently they are perhaps not pregnant further deterioration into the delinquency membership.

The brand new advised merger also arrives because the federal government are swinging to lessen the utmost enjoy interest so you can thirty-five percent for the an annualized commission rate foundation, off from 47 percent.

Fairstone is actually completely willing to meet with the government’s rules cover, with lower than fifteen per cent off Fairstone’s financing above the thirty five % price, said the leader Scott Timber.

Smith said the guy does not anticipate the federal government to lower the fresh new rates further, and therefore the guy thinks it knows that the eye pricing charged echo the chance inside.

Exactly what our company is concerned about the following six to help you 9 weeks try to place the businesses to each other … and provide much more facts in order to Canadians all over the nation.