What’s your own house’s just after renovation value as well as how could it be determined?

14 de noviembre de 2024As an alternative, the guy whipped the intimate 1938 vote towards amendment by the sending an email to the Domestic Democratic frontrunners

14 de noviembre de 2024Power. Possessions permits far greater power than many other expenditures. Such as for example, if you have $100,000 in discounts, you can purchase it from inside the a portfolio out-of offers, or use it to order a property well worth $500,000 by taking aside a mortgage having $eight hundred,000. When the shares increase of the 10% inside season, your own express collection could well be worth $110,000 and you also might have gathered $ten,000. If property rises because of the ten% in that same seasons, your property will be value $550,000 and you might have gained $50,000.

You don’t need to a giant salary to expend. When you find yourself to get to expend, lenders needs rental money and your individual money into their research. For those who already own home and now have certain security inside it, you are able to utilize that it while the a deposit, meaning that you should buy a residential property without having to select any additional bucks. If you don’t individual your own house and you may be you’ll be able to not able to afford you to definitely, to get a residential property is generally a good stepping stone so you’re able to one-day to be able to pay for your own home.

How much cash must i acquire?

We are all book when it comes to all of our finances and borrowing from the bank demands. Otherwise call us today, we can assistance with calculations centered on your circumstances.

How to purchase the mortgage that decisive hyperlink is correct in my situation?

The courses in order to mortgage items featuring will allow you to see in regards to the main available options. You can find hundreds of additional mortgage brokers readily available, thus correspond with us now.

How much cash manage I would like having in initial deposit?

Constantly between 5% 10% of your worth of property. Speak with us to discuss the options for in initial deposit. You happen to be able to borrow secured on the newest equity in your present family otherwise investment property.

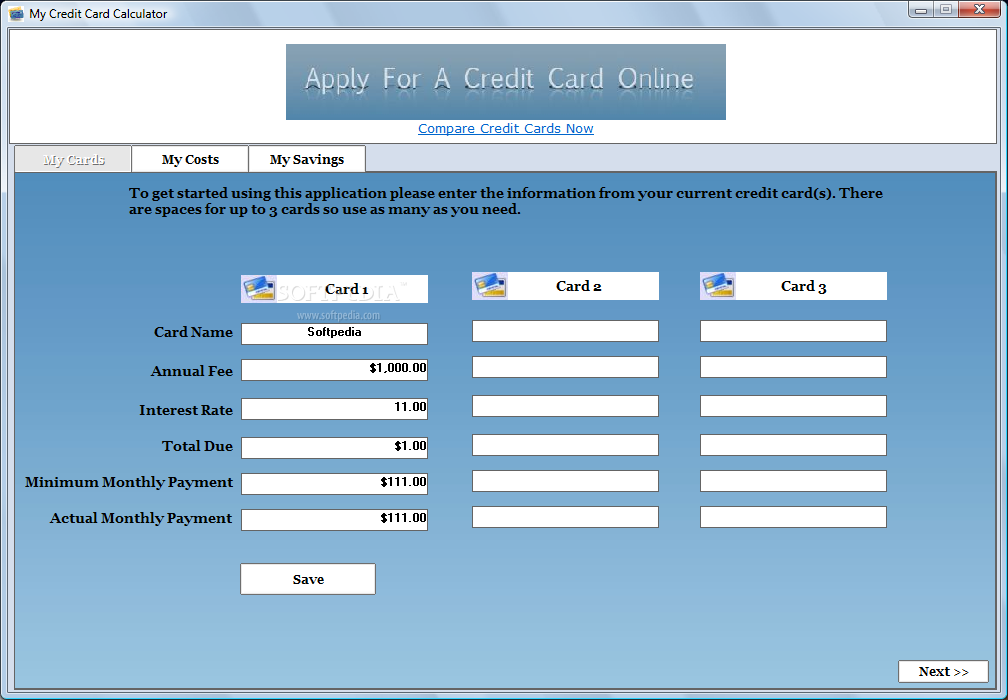

Just how much will regular repayments feel?

Head to the Repayment Calculator having a price. Because there are many mortgage things, some that have straight down basic costs, communicate with united states now about the marketing on the market today, and we’ll choose the best financing put-upwards for you.

How often would We generate mortgage repayments – weekly, fortnightly, otherwise month-to-month?

Very loan providers render flexible cost options to suit your spend course. For individuals who decide on each week otherwise fortnightly payments, in lieu of month-to-month, you’ll build significantly more money inside a year, that will probably shave dollars and you may time off your loan.

Just what costs/can cost you can i plan for?

There are certain fees inside when selecting property. To cease one shocks, record lower than sets out the usual can cost you:

- Stamp Responsibility – This is the large you to definitely. Virtually any prices are apparently quick by comparison. Stamp responsibility rates vary ranging from state and you may region governments and also have confidence the value of the property you order. You p obligation to your mortgage alone. To determine your own total Stamp Obligations fees, head to our Stamp Obligations Calculator.

- Legal/conveyancing charge – Basically up to $step one,000 $1500, this type of fees protection all the courtroom rigour as much as your home pick, as well as identity online searches.

- Strengthening examination – This should be done by a qualified professional, such as for instance an architectural professional before buying the property. Your own Deal out of Selling shall be at the mercy of the structure review, therefore if you’ll find one architectural difficulties you have the option so you’re able to withdraw on the buy without any significant economic punishment. A building examination and you may statement could cost doing $1,000, depending on the size of the property. Their conveyancer will arrange this check, and you can constantly pay for it included in the total invoice during the payment (along with the conveyancing fees).