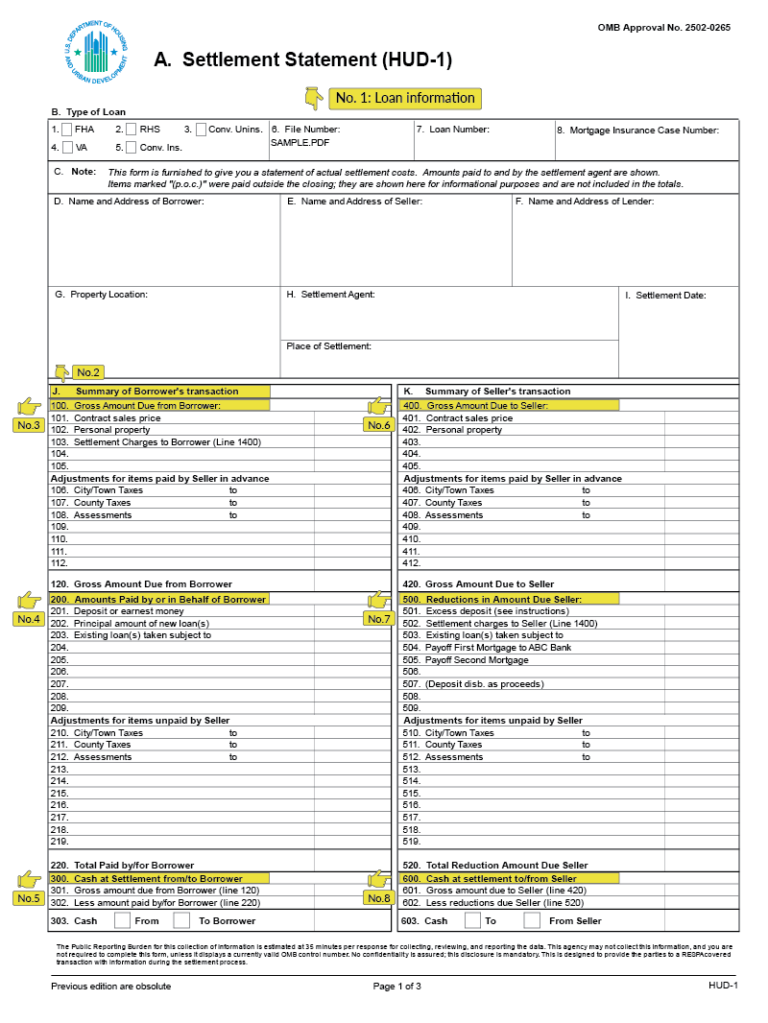

These types of charge defense many techniques from records will set you back, such as for instance term transmits and recording brand new deed, so you’re able to loan charge

3 de septiembre de 2024I Do Records in as little as Around three Era

3 de septiembre de 2024In this article:

- Mortgage Options for good Fixer Higher

- Just how The Borrowing Has an effect on Taking a mortgage

- Just how to Prepare your Borrowing for a mortgage Application

- Are an excellent Fixer Higher on the Upcoming?

For most potential homebuyers, going for a home that requires a little (otherwise a lot) of resolve is more than an enchanting belief. An excellent fixer top helps you boundary on the a house-or a region-you do not if you don’t manage to manage. You could potentially choose your build, get a hold of your favorite concludes and relish the satisfaction out-of understanding your led to the brand new conversion process.

Bringing a mortgage having an effective fixer upper demands a few even more steps. You will have to see your own house’s well worth in addition to extent and you can can cost you of requisite solutions. You’ll need plans for finding people repairs made. And you will probably must find and you may qualify for the proper funding. Bear in mind, your credit score and records will play a task inside the if or not you might effectively fund the home of the aspirations-together with repairs that can ensure it is dreamy. But your credit score is just one factor loan providers have a tendency to envision to choose the eligibility, and simply you to definitely function that will help you choose which investment suits you.

To find a beneficial fixer higher brings unique financing pressures. A normal home loan can be not the ideal choice. If the fixer upper has no operating utilities or is or even uninhabitable, such as for example, a routine lender or finance company will get balk at the extending a beneficial financing. Plus, old-fashioned mortgages usually do not normally is an allowance to have tall repairs. If you prefer a traditional financing, you’ll be able to always must find almost every other sourced elements of loans to own solutions, such with a couple of one’s dollars you might prepared for the down-payment; having fun with interim purchase and you can upgrade resource; or finding separate money, instance unsecured loans, to pay for renovations.

Rather, you can find financial apps tailored especially for fixer-upper characteristics. These include backed by government entities and provided as a result of private loan providers eg finance companies and you will borrowing unions. Having a renovation mortgage, you could add an upkeep funds for the cost and finance the entire venture which have an individual loan. The credit techniques can be a bit more difficult, requiring pre- and you can blog post-restoration appraisals, specialist estimates, multiple monitors and you can special escrow makes up about recovery fund. But the experts are obvious: You will have new investment you ought to done repairs and you will improvements-and may even features established-from inside the reserves getting unanticipated expenses. You additionally is able to fold throughout the cost of renting a place to alive throughout the home improvements towards financing and you may might even get help being qualified for a financial loan with shorter-than-perfect borrowing from the bank.

FHA 203(k) Financing

The brand new Government Property Management means loans to possess homeowners, along with FHA 203(k) finance that come with repair financing. FHA support would be an excellent substitute for homeowners that have lowest in order to moderate earnings and less-than-stellar credit. For the downside, these fund has actually restrictions precisely how much you could borrow. Needed about good step three.5% downpayment and really should pay for financial insurance coverage along the existence of the loan.

Virtual assistant Recovery Financing

The newest U.S. Department from Veterans Items promises finance having experts and you may qualifying family users. You will want a reliable income source, sufficient credit (generally speaking «good» or ideal) and you may a certificate regarding Qualification to help you qualify. When you do meet the requirements, their interest may be less https://paydayloancolorado.net/four-square-mile/ than just what you’d pay to the a traditional financial no home loan insurance rates and no downpayment required.

Federal national mortgage association HomeStyle Renovation

Fannie mae HomeStyle Recovery loans let you finance some fixes and you may improvements, and rooftop repairs and you may landscape, with your household pick. Combined with Federal national mortgage association Area Mere seconds money, good HomeStyle Renovation financial can financing around 105% mutual mortgage-to-well worth on your own fixer-higher.