Which are the Advantages of a face-to-face Home loan?

5 de noviembre de 2024Just How To Attach With A Lady On Line | Simplest Way To Lady Setting Up

5 de noviembre de 2024If you find yourself leasing, possess has just purchased a property, or come into the procedure of looking for a house to buy, you might be wondering if it’s smart to get financial defense insurance. In this post we examine what you’ll get having mortgage defense insurance and why arranging coverage is a smart choice.

Related posts.

- What is actually Life insurance policies?

- As to the reasons rating term life insurance?

- Version of life insurance coverage.

- cuatro implies lifestyle protection will pay.

- A glance at the what ifs’.

What is mortgage security insurance coverage?

Home loan cover insurance, is a kind of insurance that’s designed to cover the ability to meet their month-to-month lease otherwise mortgage payments for many who can not work for an ongoing period, due to sickness or injury.

As to why score home loan coverage insurance rates?

The choice to rating home loan cover insurance coverage can also be other individuals on your capability to continue rent or mortgage payments ticking together whether your earnings ends up for some time. A survey of the Monetary Services Council (FSC) of new Zealand within the 2022 unearthed that really operating New Zealanders have less than simply six-days value of expenses stored. A comparable FSC look revealed that 40% of the latest Zealanders was struggling to accessibility $5,000 (without starting financial obligation), in the event the some thing unforeseen would be to occur to all of them.

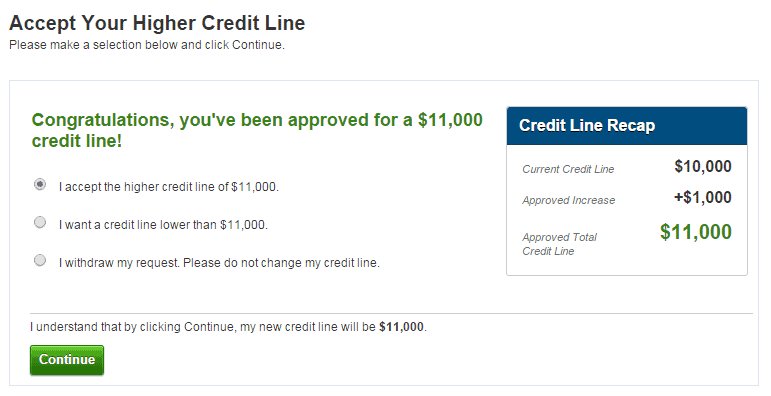

Your financial agent will help you to work out the best number to you. To provide techniques out of what is loans in Leadville North actually readily available, insurance agencies offer differing amounts of safeguards according to a percentage out of the revenues, lease or home loan repayments monthly. Fidelity Lifetime offers Monthly mortgage payment shelter with a benefit limitation as high as forty-five% of one’s gross income or 115% of one’s typical home loan repayments/lease money each month, to a total of $29,000 (terminology implement).

You could potentially choose which choice at the beginning of your cover. An economic adviser may help create a plan that is right to have your.

If you choose a prescription rehab program, for the purpose of retraining otherwise re also-training so you’re able to come back to functions, you can located additional money on top of the normal payment per month.

For many who sustained a reoccurrence of the same otherwise related illness or burns off within this a dozen-weeks from back once again to really works, the wishing several months would be waived definition you will found percentage earlier.

By taking away a special home loan or improve your current mortgage, you ount youre safeguarded having, by the around 10% .

So what can you use financial safety insurance rates to have?

Costs of a state can be utilized in any way your eg. So along with permitting spend the rent otherwise financial, money may help that have electricity and you may household bills.

Whenever create mortgage safeguards costs begin?

With Fidelity Lifestyle, you can choose whenever money can begin just after their claim has actually become approved. It indicates choosing how much time we wish to wait in advance of receiving payment. Options is 2, 4, 8, 13, twenty-six, 52 otherwise 104 months. You could pick the length of time you prefer payments to carry on. The choices was 2-age, 5-age or even to years 65. An adviser allows you to exercise what’s effectively for you.

What if my home loan repayments increase?

When you are worried about ascending interest rates which could boost your home loan repayments, pose a question to your financial adviser throughout the Fidelity Life’s CPI solution. They allows you to enhance your coverage by at the least dos% from year to year instead of bringing one scientific recommendations. This will help to to save the amount of the mask with cost of living.

Do you need life insurance to possess home financing during the NZ?

There’s not always a necessity to find life insurance policies when you remove home financing. Although not whenever you are coverage is not a necessity-provides, many assets buyers can choose to carry out home loan security insurance coverage at the same time since the carrying out a mortgage. As to the reasons? Because it can provide peace of mind delivering home loan insurance policies to safeguard their capability to repay a house financing is going to be exactly as essential because getting house insurance rates to help you cover the home regarding flames and you may disasters.

To own assistance with monthly home loan protection, talk to an expert

Decision-making throughout the home loan protection insurance is simpler if you get help from a monetary agent. You can seek advice, think individuals alternatives and there’s zero responsibility to shop for.

DISCLAIMER: Everything contained in this blog post try a list of the latest key points of your own insurance cover said and that is standard inside nature. This short article doesn’t comprise an economic guidance service. The covers try subject to this new meanings, fundamental conditions/limits, conditions and terms part of the full coverage papers which is available from Fidelity Lives or your financial agent which retains a beneficial Shipments Contract with Fidelity Life. All programs to own cover is actually susceptible to underwriting conditions.