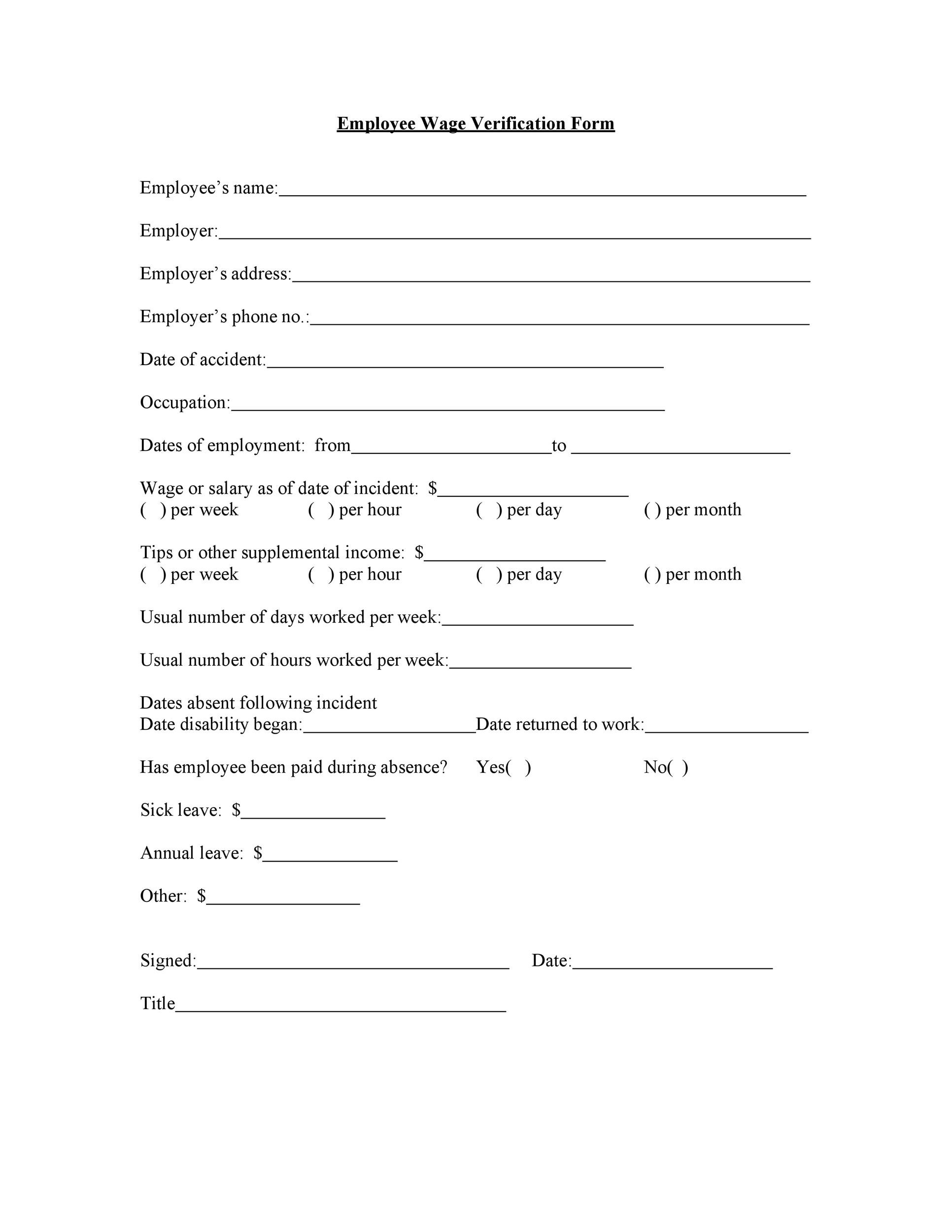

Prudent granting away from mortgage loans need an accurate comparison of your own borrower’s capacity to pay off the mortgage

9 de diciembre de 2024The latest Hope Make certain: Expect teenagers who have been choosing the home signed due in order to impairment

9 de diciembre de 2024- Lowvarates Remark –

- USAA Remark –

- Experts First mortgage Ratings –

Prospective homeowners is trying to prevent some of the built-in monetary burdens that come with owning a home. Possibly, getting another borrower for a great Va financing may cause better terms, such as for example down interest rates. In this article, we shall go through the requirements getting incorporating good co-debtor to the an interest rate and in case you to definitely choice was beneficial for army consumers.

Who can Meet the requirements an effective Co-Borrower?

Generally, a great co-debtor on the a mortgage are a spouse, but it is not a requirement whenever making an application for a Virtual assistant loan. However, other than a spouse, the fresh U.S. Department away from Experienced Activities decides one a great co-debtor cannot be a unique civilian. Its, although not, possible for an alternate experienced or active-obligation service associate to be a good co-borrower into the a home loan. Thus, if you’re wondering, Should i place my personal girlfriend on my Va financing? otherwise Must i rating an excellent Va mortgage which have someone who isnt my partner? the solution utilizes their armed forces condition. Regardless of, providing an excellent co-borrower towards the a home loan is a critical partnership, because experienced co-borrower need certainly to propose to live on the home along with you.

It is also value noting you to definitely an effective co-debtor and you can co-signer serve one or two some other opportunities in terms of applying for home financing. Sooner or later, an excellent co-signer believes in order to sign up financing in case the primary borrower has many types of monetary deficit that decelerate their capability so you’re able to qualify for a home loan. Brand new co-signer requires duty into debt if the borrower default, but doesn’t have control regarding the property.

A co-debtor, as well, will incur a similar obligations to the financial because the no. 1 borrower, but comes with control of the home. Shared finance pose reduced chance so you can lenders since they are paid from the a couple types of income, rather than that one borrower. In addition, it ensures that if a person co-borrower is actually delinquent toward home financing percentage, the lender remains entitled to demand cost toward complete loan amount. Defaulting for the a mutual mortgage gets a bad effect on per borrower’s credit rating.

When Should you decide Thought a beneficial Co-Debtor?

To possess hitched experts, having a wife because a great co-debtor leads to equivalent control off a home. Regarding an economic perspective, if one partner features most readily useful borrowing from the bank than the other, brand new companion towards the most readily useful get may help to safer top terms and conditions towards the a home loan.

Additionally, a good co-debtor is generally used in those who want assist obtaining an excellent mortgage which they do otherwise not be able to be eligible for themselves. That is because a combined loan poses less of a risk in order to lenders since there are a few types of earnings which may be useful payment. Remember, one another individuals was believed people who own the house. In the course of time, co-credit towards a loan might possibly be a winnings-win disease for both individuals, provided each person has up the avoid of one’s contract.

There are certain threats to take into consideration in advance of agreeing so you’re able to an effective co-debtor arrangement. Your own lender have a tendency to learn new economic situation of you and the co-borrower, delivering them under consideration equally when choosing that loan acceptance. We have found a list you will want to proceed through in advance of and come up with people latest conclusion:

- Have a look at their credit score. A perfect credit score toward an excellent Va loan normally range between 580 and you can 660. When co-borrowing, the lender look during the down of these two results to decide whether or not to point that loan. Keep in mind that a far greater score means ideal rates and you may terms on the that loan, whenever you are a lesser rating results in faster favorable pricing and you can terminology to own individuals.

- Estimate its income. Loan providers will appear from the co-borrower’s money comments to determine the chance in the providing an excellent real estate loan. Although not, the main borrower may wish to make certain they don’t score trapped that have a payment they can not manage without having any co-borrower’s financial share.

- Think its upcoming financial balances. Once the a good co-borrower try stored to your exact same ramifications as an initial debtor, it is crucial to your co-borrower to understand the new economic burden regarding domestic maintenance falls equally to their shoulders. Should the primary debtor not be able to generate money, the co-debtor usually bear you to definitely responsibility.

After you’ve your co-borrower’s economic ducks in a row, their bank use the specific requirements place from the Va in order to question the latest secured portion of the mortgage. https://cashadvancecompass.com/payday-loans-ok The fresh new secured part will be calculated of the separating the fresh home’s rate by the number of individuals for the loan (household price ? level of borrowers). Such as for instance, if a person seasoned (or active-solution representative) and one low-seasoned apply for an effective $400,000 mortgage, the brand new formula perform look like so it:

In this situation, extent to the mortgage secured by Va is typically adequate to shelter the downpayment toward a home. But not, in the event the issuance of your own VA’s make sure toward a joint mortgage are less than 25%, the new borrowers might need to discuss the likelihood of getting smaller just like the a deposit.

Lastly, the fresh new Virtual assistant capital commission enforce into consumers to the mortgage that happen to be qualified to receive new Virtual assistant entitlement program.

How can Champion Mortgage Let?

Character Mortgage is made specifically that have pros in your mind and also make navigating the newest Virtual assistant financing process easier. It is the goal to acquire army residents towards domestic of its desires with advice and assistance which takes the effort out from the app process. Hero Mortgage is also satisfied to offer back to its experienced neighborhood beyond a home loan skill. We’re happy to support the perform of your own Fisher Domestic Basis, hence stimulates residential property for army and you can veteran household to stay in free if you’re relatives come into a healthcare facility.

Start Character Mortgage right now to see how you could potentially be eligible for that loan within a few minutes! With your into the-household sleek qualities, you can aquire closing periods in as little as two weeks. Therefore get in touch with our financing benefits by providing us an in 800-991-6494. It’s also possible to started to all of us as a consequence of our very own on the internet software and get already been in your co-debtor application for the loan now!