Resultado de las Badoo opiniones ?Verdaderamente Hace el trabajo?

7 de octubre de 2024The brand new Degree toward Basis Conformity is not needed in the mortgage document or guaranteeing binder to possess:

7 de octubre de 2024Your house could be the largest get your actually generate. Choosing to purchase a home is a big choice, so it is necessary to make sure it is a considerate alternatives too. Making the effort to learn exactly how being qualified to possess an interest rate functions will help make procedure as fulfilling because exciting.

When you submit an application for the loan, lenders will during the some guidance. Nonetheless it sooner relates to this type of about three something: the credit, income, and you will property.

1. The Credit

Lenders tend to review your own history having a request on the three biggest credit reporting agencies TransUnion, Experian, and you will Equifax. Every piece of information they assemble can assist them take advantage of told decision about mortgage qualification procedure.

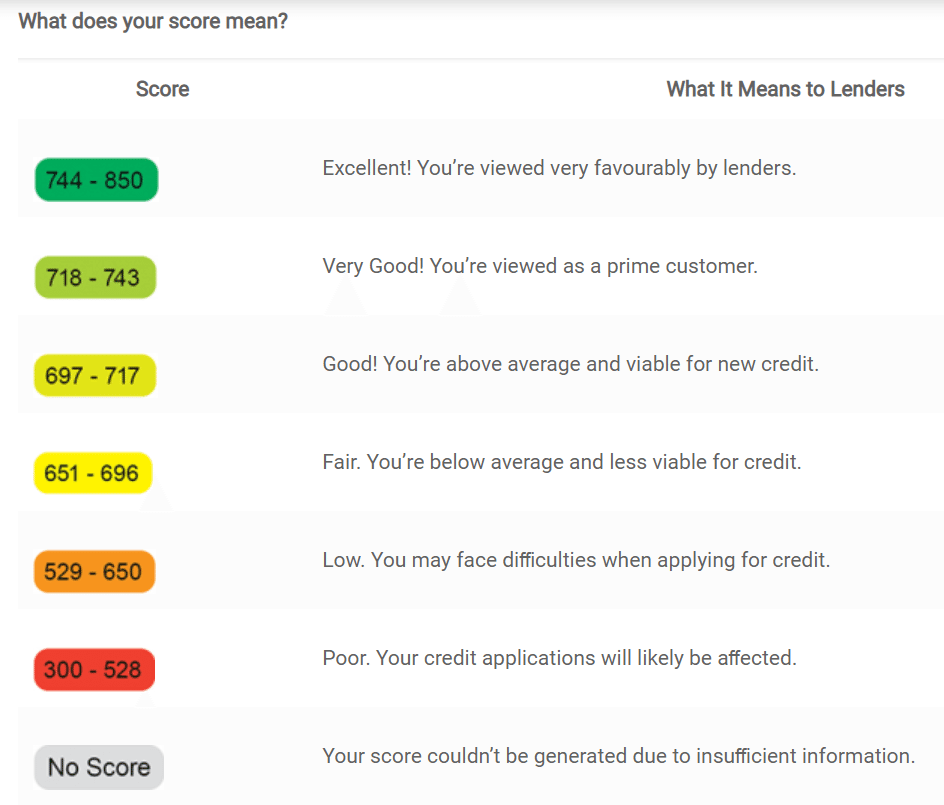

Next to your credit report was a calculated credit history, known as good FICO rating. Your credit rating vary from around 300-850.

Lenders put their own criteria for what score they will deal with, but they essentially think about your payback history, if the costs were made timely, and in case the mortgage is actually paid down in full.

Your credit score try a deciding factor having a home loan qualification, plus it support determine the interest rate that you will get. The higher your rating, the easier its to help you qualify for a home loan.

Now that you have an insight into borrowing, you can also ponder how-to improve your score. Consider each other your credit score therefore the declaration the quantity comes out of as well.

Come across mistakes otherwise financial obligation amounts noted that do not end up in you. If you look for errors, take the time to contact the brand new creditor and you may disagreement all of them precisely. The new creditor’s information is listed on the statement for simple source.

dos. Your income

2nd, your income also issues in the degree process. Loan providers commonly evaluate your debt-to-money (called DTI) proportion. The DTI has all your valuable repaired costs – expenditures which can be an equivalent amount monthly – along with the brand new mortgage.

These expenses is actually next analyzed against their terrible monthly money (before every fees try subtracted). This helps their lender determine whether you will be spending less compared to necessary fifty% of one’s terrible month-to-month income with the people repaired expenses.

Varied expenditures instance tools, cord, otherwise mobile phones aren’t as part of the DTI ratio. You can bookmark which since a simple reference to have terms so you can discover from the process.

3. Their Possessions

Assets are critical to the brand new certification process. Possessions was issues own that have a value. Hence, anything you’ve got from inside the profile that might be drawn aside while the cash is noted because an asset.

Bodily possessions is sold having financing to raised qualify for home financing. These types of assets is, but they are not limited to help you, factors for example properties, homes, autos, ships, RVs, precious jewelry, and visual.

The financial institution ple, they will certainly should make sure the total amount you are playing with into the downpayment is available into the a water bucks membership, such as for instance a verifying or family savings.

Together with, according to the particular financial support you will be trying to, there might be a necessity to own a constant dollars reserve. Supplies change from possessions because the a reserve is really what you have remaining before you make a downpayment or expenses people closing costs. These reserve criteria be much more popular when trying to invest in a great second household otherwise investing a home.

Attaching They Together – Learn Your loan Models

I discussed the importance of your FICO get before, however it is beneficial to observe that certain home loan types has actually independency for the scoring official certification.

A conventional financing are a home loan maybe not funded from the a national company. Very conventional finance was supported same day payday loans in Fenwick by mortgage businesses Federal national mortgage association and you may Freddie Mac computer. The typical minimal FICO score regarding 620 is normally required when applying for a conventional financing, however, loan providers usually make individual dedication on this subject.

Va funds is protected from the U.S. Institution regarding Pros Facts. They’ve been intended for experts, active-responsibility military participants, and qualified surviving spouses. The Virtual assistant does not place the very least credit score for those finance, and you will lenders can form their unique standards.

Mortgages supported by brand new Government Construction Government (FHA) can handle very first-big date home buyers and you may reasonable-to-reasonable money individuals. This type of fund require shorter down costs than other kind of mortgage loans.

The latest U.S. Department away from Casing and you will Metropolitan Innovation states you are able to qualify for an enthusiastic FHA loan having a credit score out-of five-hundred provided that since you set-out at the least 10%. That have a high FICO credit history-at the least 580-you may also meet the requirements which have a deposit only step 3.5%.

Better Tx Borrowing from the bank Union Mortgages

At the Better Tx Credit Union, we is preparing to make it easier to like a mortgage loan to suit your demands. We know being qualified getting a mortgage is another processes. And it appears other for everybody provided borrowing, possessions, and you can money can vary.

Simply click below for more information on getting a mortgage out-of a card Connection. Or write to us if you have questions. Our company is constantly right here to greatly help!