What is Personal Home loan Insurance? The way it operates and how to Avoid Expenses PMI

1 de octubre de 2024What is a provided Equity Arrangement and exactly how Will it Works

1 de octubre de 2024While best-known for its low down commission alternative, there’s alot more understand regarding the FHA funds when considering them. This informative guide tend to take you step-by-step through a guide to FHA funds of the responding the primary issues new home buyers enjoys on the merchandise.

Inside the 2018, almost 17% of all the home loans had been backed by the brand new FHA together with bulk of those financing-83%-went to earliest-day homebuyers. Despite the popularity of FHA money, of several homebuyers do not understand how they really works.

What’s an enthusiastic FHA financing?

The Government Construction Administration (FHA) is the prominent home loan insurance company around the globe and also insured more than 46 billion mortgage loans due to the fact their beginning from inside the 1934. New FHA will not fund finance. Instead, it means mortgage loans made by FHA-acknowledged loan providers.

Just how can FHA loans works?

FHA financing are part of several financing that will be backed by the government. This means that in place of indeed financing money, new FHA now offers a pledge so you’re able to https://paydayloanalabama.com/black/ banking institutions and private loan providers you to they are going to cover loss they happen when the this new debtor will not pay back the loan completely.

This is why reduced risk, lenders are able to give money with reduce payments so you’re able to consumers having poor credit otherwise limited income. Just like the FHA can make mortgage loans significantly more open to individuals with restricted earnings and you may borrowing from the bank, there’s no earnings limitation of the FHA finance and you may people which match minimal being qualified standards can enjoy the huge benefits.

As a result of the interest in the application many lenders is accepted provide FHA funds. To greatly help determine whether the financial institution you’ve chosen are FHA-acknowledged you might enter into the information regarding the fresh new Agency from Homes and you can Metropolitan Development’s (HUD) financial lookup unit.

Whom you are going to an enthusiastic FHA mortgage getting right for?

While you are FHA financing are available to various sorts of consumers, they may be like better-suited to very first-time homebuyers and you will buyers which want to live-in our home full-date.

Minimal deposit element just step 3.5% (that have a minimum credit score of 580) having a keen FHA mortgage renders homeownership more attainable for these with absolutely nothing deals. First-go out homebuyers benefit from the program simply because they don’t have security off a past home profit to get with the the off payment.

If you are FHA funds is actually attractive to very first-day homeowners ergo, there is absolutely no demands that you must feel buying your very first home so you can qualify.

Given that FHA finance are part of good federally funded system so you can encourage homeownership, they’re not offered to traders otherwise someone to order a moment family and their primary residence. Any household that is ordered which have a keen FHA loan have to usually function as borrower’s primary house.

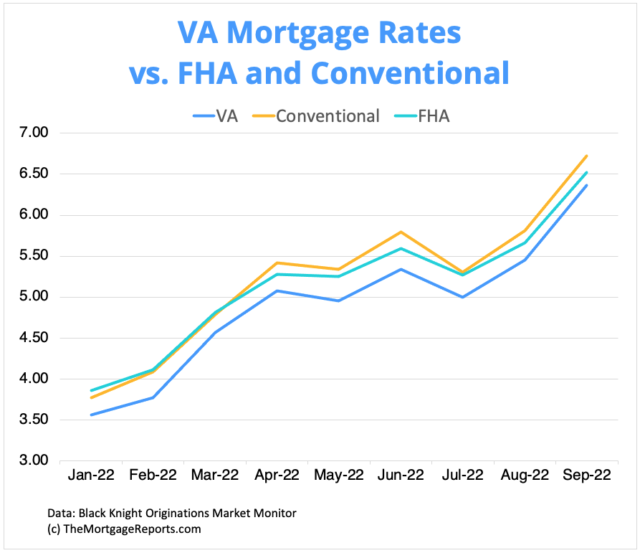

What’s the difference between an enthusiastic FHA and a conventional loan?

Antique money try mortgages that aren’t supported by a federal government be sure. He could be normally considered to be much harder to help you be eligible for but give individuals greater independence.

That significant difference between FHA and you will conventional otherwise fundamental home loans is the fact that lower initial cost of an FHA loan tend to means its costly over the years. A diminished downpayment setting a bigger display of the house price is funded therefore, the buyer pays so much more notice over the longevity of the mortgage. A top down-payment and have a tendency to causes spending shorter for financial insurance policies. Lenders will normally waive the borrowed funds insurance rates payment altogether in the event your borrower sets 20% or more down.

* For 1-product attributes. Real loan limit relies on the fresh new county. Highest limit needs a jumbo financing on added cost ** For example-tool characteristics, with respect to the state Sources: U.S. Information and Community Report; Investopedia; Federal national mortgage association; The mortgage Records; Federal Property Money Agencies (FHFA); Agencies from Housing and you will Metropolitan Creativity (HUD)