When there is a need to make a bespoke home but not instantly, an area mortgage is a fantastic choice

23 de septiembre de 2024As stated a lot more than, experienced dealers will take advantage of household flipping

23 de septiembre de 2024Once you don’t possess a good credit score and need so you’re able to borrow money, you actually thought you may be sunk – however is wrong. Even with everything you may have read, discover finance available for people with less than perfect credit and even money for those who have zero credit. For those who own your home, you may still be eligible for a loan having poor credit.

Getting property Guarantee Financing Having Bad credit

All consumers, long lasting the credit rating, have to done some basic steps to acquire accepted for a financial loan. Nevertheless when the borrowing from the bank try bad, you will find a lot more tips make an effort to over getting a chance for an ensured family collateral mortgage getting bad credit. Here’s what you should do to get property collateral loan with less than perfect credit:

step 1. Opinion and you will Replace your Credit rating

Actually a modest improvement in a credit rating helps you to save plenty out of cash during the period of financing, told you Michael Dinich, economic advisor to suit your Currency Things. Borrowers is eliminate its private ratings from all three bureaus and you may proper people inaccuracies. Dinich along with mentioned that borrowers can be careful which have borrowing fix features, specifically those who promise a magic pill for a fee.

dos. Choose a house Collateral Mortgage otherwise property Equity Distinct Borrowing from the bank

Providing good HELOC and a home collateral mortgage one another encompass borrowing money up against your house. Which have either of these fund, it’s possible to acquire up to 85 per cent of your value of your property – less people outstanding home loan numbers – even after poor credit. Like an excellent HELOC if you’d like to access the bucks thru a line of credit on the a for-expected basis while making costs with the amount borrowed, otherwise come across a house guarantee loan for folks who want a giant sum of money initial and can build fixed money per month.

3. Gather the desired Data files to apply for the mortgage

Same as after you secure their home loan or refinanced a current home loan, you will have to provide the lender that have a host of data files whenever trying to get a property collateral mortgage or HELOC. Start by discovering your newest tax statements, shell out stubs and lender statements to show your income. Then proceed to finding your home survey, proof insurance policies, and you will identity plan for the property.

cuatro. Purchase yet another Home Assessment

Just before a loan provider approves a house equity loan that have bad credit, it will need observe proof of how much equity your enjoys of your home, that’s over because of a property appraisal. Individuals that do n’t have a recently available home appraisal offered often have likely to pay for a separate one.

5. Think an excellent Cosigner

Cosigners offer loan providers https://paydayloanalabama.com/pike-road/ with cover since they are liable to pay back the borrowed funds if you standard on repayments within when. Although this action are recommended, an excellent cosigner helps you become approved when you yourself have an excellent reduced personal debt-to-income proportion. A good cosigner may also be helpful you get a far greater interest rate for people who entitled to the loan but have a minimal borrowing from the bank rating.

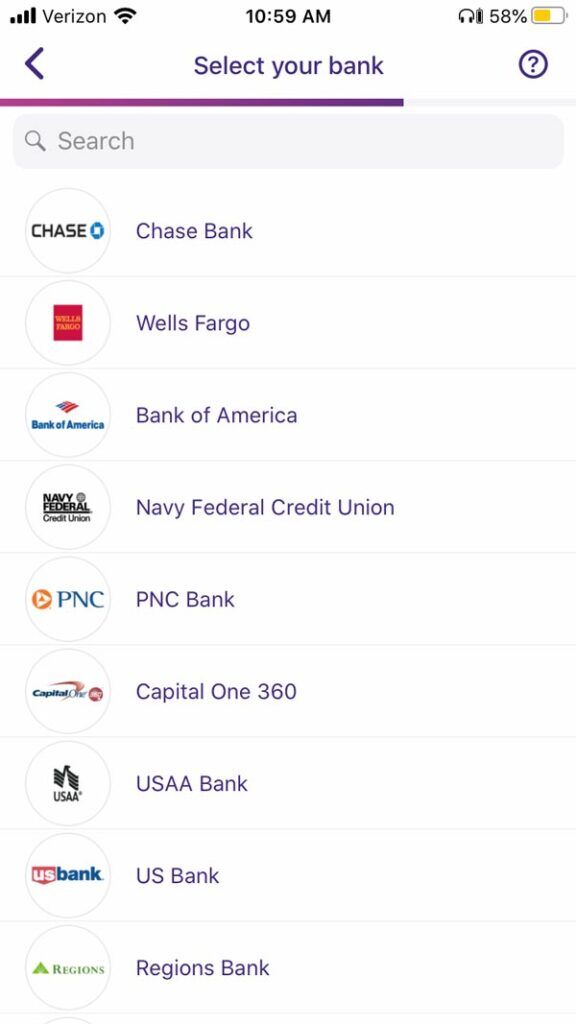

6. Feedback Offers Away from Several Loan providers

Once you affect several other people, you’ll want to examine family collateral mortgage cost. Investigate interest rates, settlement costs and speed structures to see which one to best suits your needs. Query lenders any questions you really have. It is crucial that you learn all the terms of this new mortgage before signing toward dotted line.

What to anticipate Of a home Equity Line of credit With Less than perfect credit

In the event loan providers you are going to accept mortgage brokers to have consumers which have poor credit, you could sense certain downsides of getting less than perfect credit loans. Do not be amazed for many who discover conditional acceptance toward financing, which is a summary of requirements in order to meet before you can intimate it. A great lender’s criteria might were:

- Providing their taxation statements so the underwriter is guarantee deductions

- Taking emails of factor having borrowing concerns, bankruptcy filings, foreclosures otherwise brief sales

- Trying to find an effective cosigner that a good credit score

You can also have your very first application rejected because of your credit score, but often the lender is certainly going as well as need a closer go through the good reasons for an awful score. Despite a reduced rating, a lender might still approve the loan if you have good large downpayment and no later repayments over the past year.

Even although you has poor credit, will still be you can easily discover property security financing. Particular lenders are willing to capture a danger as the mortgage will be secure with your household since the collateral. All the loan providers are certain to get a set of standards you need to meet are acknowledged, although not, and some will provide greatest pricing and you will conditions than others. Shop around and compare proposes to have the best price.