The reasons why you May want to Think twice Before getting A house Equity Financing

26 de enero de 2025How a property Recovery Mortgage Make a difference the worth of Your Home

26 de enero de 2025Spring mode flowers, warmer temperatures … and you can a property-buying madness. This is because the new most hectic weeks to invest in or offer a house are typically April, May and you may June. And you can whether you’re a professional domestic-huntsman or an initial-big date buyer, it’s important to see your house-loan choice prior to beginning the process.

Fixed-Price Financing. Widely known sorts of was a predetermined-price (or conventional) mortgage, for example there’s one rate of interest (and you can payment) with the longevity of the loan, that’s generally 15 or 30 years. This type is good for homeowners who need predictability, and you can plan to remain in that spot for a little while.

Government Homes Administration (FHA). FHA loans repaired and changeable rate fund backed by the brand new Federal Houses Expert (FHA) regarding Company regarding Housing and you may Metropolitan Innovation (HUD). It is best for the financial institution just like the bodies ensures the latest loan. They’re able to accommodate a lower life expectancy downpayment often only step three.5% (regular money usually need 20% of cost of the home). Such loan is normally a good fit of these that have little discounts or bad credit. Additionally, it is advisable for those who are just doing away, or perhaps in the midst of a critical lives change.

Veterans Issues (VA) Financing. When you have supported in the united states armed forces, a veterans Products mortgage could be the perfect choice for you. For folks who meet the requirements, these mortgage also offers Experts special masters, such as for instance zero advance payment otherwise monthly home loan insurance coverage. At exactly the same time, closing costs which are purchased from the provider. There are particular standards, not, toward variety of family you can purchase: it must be an initial quarters and you can fulfill a certain put regarding conditions.

We provide a variety of traditional financing that have lowest pricing and flexible terms

An effective jumbo mortgage are a home loan to possess an amount you to definitely exceeds compliant financing constraints built by regulation. The brand new jumbo financing restrict is $417,000 in most of one’s You. The newest limit into jumbo finance was $625,500 regarding the high-cost section. You can expect resource choices for to $dos.5 billion.

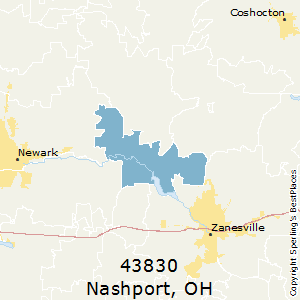

USDA Financing. If you are USDA finance are designed for group for the rural parts, also they are designed for suburban homebuyers. Government entities finances 100% of the home rate (and thus a deposit is not required), and interest levels try deal. Almost every other masters become versatile borrowing from the bank guidelines, and there is zero limit price restrict.

Opposite Mortgage loans. These loan is actually for elderly people at the very least 62-years-old, and needs no monthly mortgage repayments. Individuals continue to be accountable for assets fees and you can homeowner’s insurance rates. This package lets parents to get into our home guarantee they have built up in their house, and you may delay commission of your mortgage up until it pass away, sell, otherwise get out of the home. Since there are no required home loan repayments into the an opposite mortgage, the attention was placed into the mortgage harmony every month.

JUMBO Loan

Money spent Loan. Good for individuals who put money into a https://paydayloanflorida.net/crescent-beach/ residential property, money spent finance provide a variety of resource choices for characteristics from one to four home-based or trips products from the a thirty-season fixed rates.

House Security Financing. This is exactly a convenient method for latest home owners to borrow cash to pay for things such as knowledge costs, home improvements, medical expense otherwise debt consolidation. The loan amount relies on the value of the house or property, and also the worth of the home varies according to an enthusiastic appraiser throughout the financial institution.

We realize that household-to buy techniques can be challenging. Regarding debt means and you will deciding which mortgage suits you we could assist. Contact financing manager to arrange a scheduled appointment at the nearby Family Horizons Borrowing Partnership now, or label (317) 352-0423.