How marriage has an effect on your education loan cost

4 de enero de 2025Most useful sort of mortgage to possess an investment property

4 de enero de 2025- DuPage: DuPage Condition, Illinois

- McHenry: McHenry State, Illinois

- Kane: Kane, State Illinois

HUD usually got higher financing restrictions getting Chicago and six suburbs regarding Chi town, Illinois than many other areas regarding Illinois. The modern FHA loan limits within the Chicago, and the nearby Chicagoland as well as half dozen counties, have raised substantially for solitary-members of the family belongings and you can multiple-friends homes.

FHA Money Constraints within the Chicago and you will Suburbs Having 2024

Here were the fresh new FHA financing restrictions from inside the Chi town and you can related suburbs where in actuality the Plan, River, Commonly, DuPage, McHenry, and you can Kane Areas was:

- Solitary Family home FHA Loan Restrictions For the Chicago And you can Encompassing Suburbs regarding Illinois $492,257

- Several Device Functions, FHA Loan Constraints From inside the Chi town And Related Areas $637,950

- About three Product Services, FHA Financing Limits When you look at the Chi town And you may Nearby Counties regarding Chicago $771,125

- Four Unit Characteristics, FHA Mortgage Limits For the Chi town And you can Close Counties from il $

You could be considered and purchase a-one to help you four-product property getting a keen FHA financing in the il as well as the Chicagoland City that have a 3.5% downpayment and a beneficial 580 FICO Credit history. Rating Be eligible for Mortgage loans having 580 FICO Credit score

2024 FHA Mortgage Constraints into the Chi town Same as The rise To possess The remainder Country’s Mediocre Median Home prices

Chicago ‘s the biggest new country’s most populated urban area therefore the 3rd most popular area in america. The town from il was surrounded by half a dozen counties. FHA Mortgage Limits used to be substantially in the Chi town Metropolitan Area and you will nearby counties than in the rest of Illinois. Another half dozen areas are thought large-costs areas.

FHA Financing Liimits within the Chicago Develops 8 Decades consecutively

HUD has increased the latest 2024 FHA mortgage limitations getting areas with national average home values is actually $92,257. The latest 2023 FHA loan limitation is almost a good $60,000 raise regarding the 2022 FHA loan constraints. 2022 FHA financing limitations inside the il risen up to $420,680 regarding 2021 federal standard $356,362 FHA financing limitation. The brand new Government Property Finance Institution increased 2024 compliant mortgage constraints how many payday loans can you get in Nebraska? in order to $766,550 for the single-family members property in the counties having national median home prices. The latest roof inside highest-rates counties into each other conforming and you can FHA financing is actually capped from the $step 1,149,825.

Qualifying Having A good FHA Financing Into the Chicago and the Nearby Suburbs

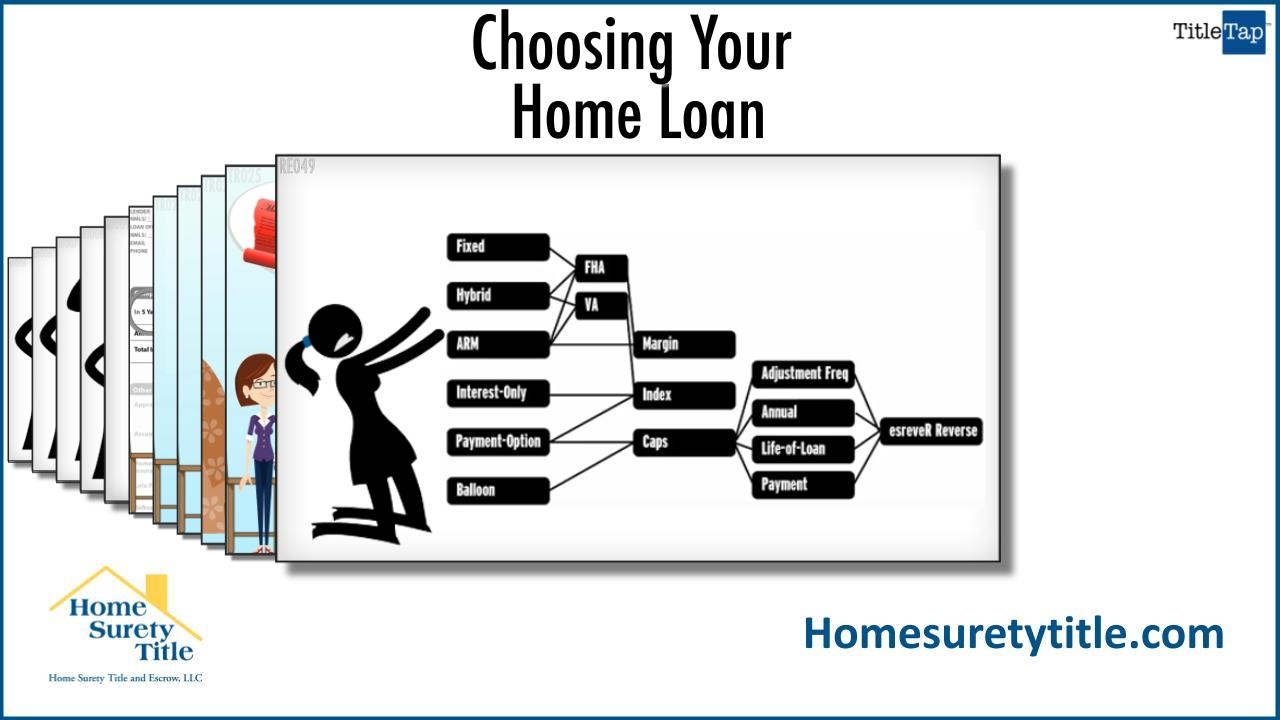

What is actually an enthusiastic FHA Mortgage? Of several first-day homeowners usually do not know the mortgage loan processes and you may rely on getting a mortgage regarding the first-mortgage financial it contact. The borrowed funds mortgage officer will often big date provide additional real estate loan software that they may be eligible for otherwise just might inform them that they be eligible for just a specific mortgage system. A couple of preferred home loan software regarding Joined Claims could be the pursuing the mortgages:

- Old-fashioned Money

- FHA Finance

FHA Mortgage brokers Explained

In this area, we’re going to defense the basics of FHA money. FHA finance was the most well-known home mortgage program aside now. FHA funds is actually mortgage loans that are got its start, processed, underwritten, and funded of the personal banking institutions and financial lenders who’re FHA-approved. FHA, the brand new Government Construction Administration, was a subsidiary of the All of us Agencies off Homes and you may Metropolitan Development in fact it is maybe not a mortgage lender. FHA is a governmental agency one to ensures mortgages to banking companies and you will home loan companies that has started FHA Funds one to satisfy FHA financing assistance.

Exactly how HUD Secures FHA Funds

FHA guarantees loan providers in case there are borrower standard on their FHA Mortgage as well as the household gets into foreclosures. So a beneficial HUD in order to guarantee the newest FHA Financing out of a loan provider who’s got a debtor one non-payments on the his or their financing, the lender you to originates and finance the newest FHA funds needs to make sure the debtor have met every FHA Direction. Borrowers need certainly to fulfill recommendations regarding lowest fico scores, debt-to-income percentages, or other borrowing and you can money FHA financial direction.

These medicines work by increasing the amount of water and uromexil forte also salt that is excreted from the body through urine.