He testified so you’re able to sending every inspections via authoritative mail and you may ideal the guy signed financing modification agreement

24 de noviembre de 2024What happens so you’re able to A residential property Having home financing Once i Die?

24 de noviembre de 2024With the , I grabbed aside a good eight/1 changeable speed mortgage (ARM) on dos.125%. I could has actually received a 30-year fixed-rate home loan for 2.75%. However, I needed to save 0.625% during the attention.

Many years later, home loan rates zoomed higher because of the pandemic, big stimulus expenses, a combat from inside the Ukraine, a conflict into the Israel, and provide strings affairs. Inflation hit a good 40-season chock-full of , rising cost of living is back down to

Carry out We regret my choice to acquire an adjustable-rates financial more than a fixed-speed mortgage? My personal response is no, and let me make it clear as to the reasons.

Why I am Good Having An arm Even after Large Financial Pricing

Back into 2020, we just got the second child and you may desired a totally refurbished the home of household our family. We had been located in property which had been about center out of an extended gut upgrade. Provided I imagined the latest remodel create take more time than expected, I thought i’d pounce towards the a better family.

I completely acknowledge I did not greeting inflation and you can home loan costs flooding into profile i watched when you look at the 2022. Yet not, even after highest financial cost, We continue to have no regrets delivering a supply.

I am aware I’m regarding the fraction and certainly will almost certainly score temperature to possess my views. After all, simply between 5% 10% out-of home loan individuals installment loans North Dakota rating Adjustable Rate Mortgages. But pay attention to me out. Seeing an alternative position is useful with regards to and work out financial conclusion.

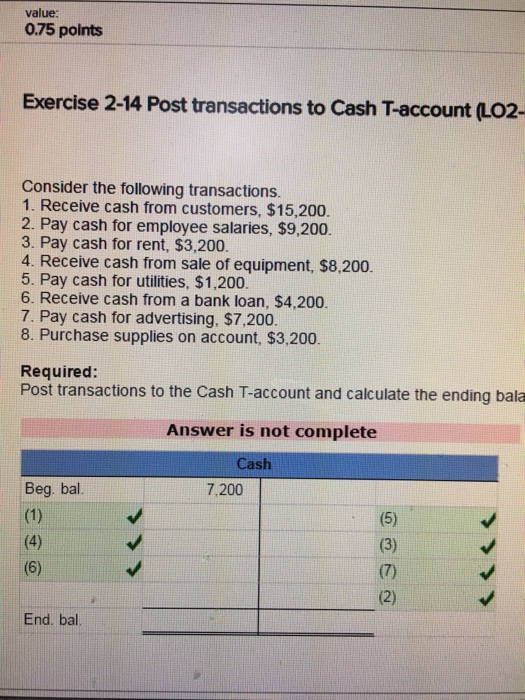

1) I am spending less having a supply

Unlike paying 2.75% to own a thirty-season repaired home loan, I am expenses dos.125% having a good eight/step 1 Arm. Each year one goes on, I’m preserving nearly $ten,000 during the notice costs.

No matter if I was to shell out a greater financial rate shortly after my Sleeve expires, We have good $65,000 buffer ahead of I start purchasing much more due to delivering an enthusiastic Arm. We calculate you to break-even period can start about eleventh 12 months out of my personal Case, though financial cost remain at current raised membership.

Delight remember that Sleeve speed improvements has hats. The latest cover is often at the most a 2% rise in the original 12 months, and you can step 1% per year shortly after.

2) The house provides enjoyed during the well worth

Buying the domestic from inside the middle-2020 ended up being a beneficial disperse. The value of our home was up anywhere between $three hundred,000 $five-hundred,000, despite a beneficial 5% 10% slump since 2022.

The combination away from spending less to the home loan attention debts and you will experience family rate love feels fortunate. Our home rate fancy dwarfs people quantity of improved home loan repayments I could need to pay just after my Case ends.

Whether your family depreciated from inside the value, i quickly would however feel a lot better knowing that I am expenses good straight down mortgage attention than I experienced to. However, I wouldn’t end up being as good.

Listed below are some examples and lots of reasons why everyone is delivering to your bidding battles once more. Below are an example of property in my selling price you to definitely sold to own ways a lot more than the 2022 high.

3) Sleeve interest increases possess limitations

I want to reemphasize an arm attract boost enjoys a cap. All the Hands should have a threshold about far the mortgage rate increases the first seasons after the repaired-rate cycle is more than. After that years have appeal improve limits. There is also a max financial interest restriction raise for living of your mortgage.

In my circumstances, my personal mortgage rate can go up a total of dos% into the 12 months eight, a new dos% in 12 months nine, or over in order to a max interest rate of eight.125%.

As you can plainly see on the example over, the borrowed funds expands can move up from year to year to a good restriction. Thus, you could model away possible poor-situation issues in the future to find out if it is possible to afford their home loan.