Treatment houses obtainable in columbus kansas (2022)

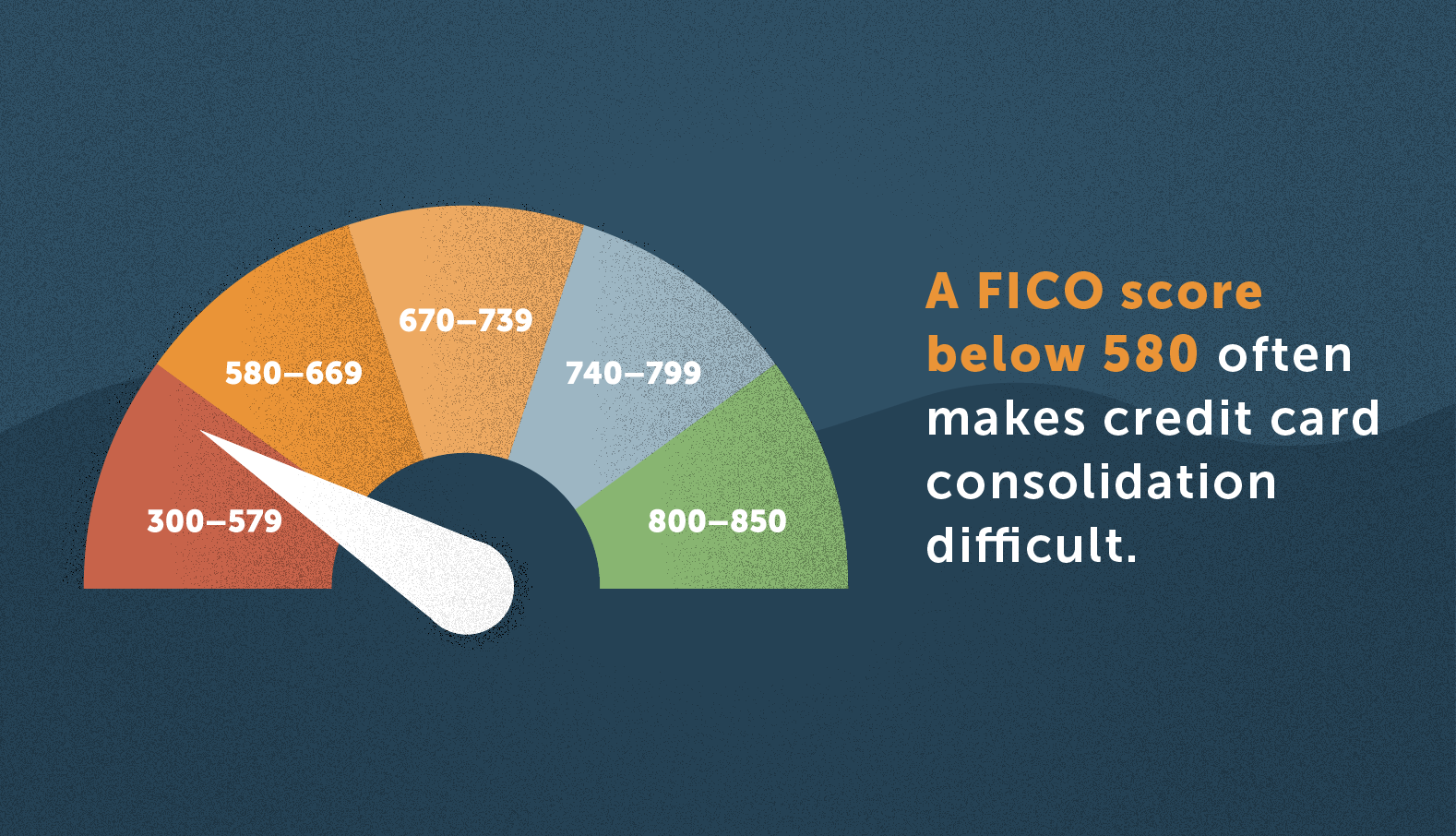

4 de agosto de 2024Generally, lenders are looking for a credit history that is certainly believed «good» or perhaps more than average

5 de agosto de 2024To shop for a house was a lives-modifying experience which may be exhausting – specifically if you need to rating a property that give specific leases to own a disability. You can also contemplate using a mortgage calculator to adopt exactly how your own monthly mortgage repayments will fit into your budget. When you are just one with disabilities there could be extra factors you should make, at the top of all of the usual what you should find whenever domestic hunting.

This might are given how your brand new house will meet their individual needs. As well, try to look at the requirement for the region regarding the house inside the proximity to particular services and characteristics you could frequently use, such public transit or regional drugstores. you will must believe other aspects of our home, which could include the physical layout and you will access to – or if the household will be remodeled to include necessary accommodations.

While deciding the usage of regarding a home, you may have a few alternatives. You might work with an expert a house provider to find a house that is already based, and you can need certainly to ready yourself making one required improvement getting use of. Otherwise, you may choose to split crushed which have new construction on the ability to customize a house to satisfy yours requires. To order another framework domestic can also be a solution, as they could have significantly more discover and you can trendy floors preparations one have been developed having usage of in mind, or you can inquire about change towards the flooring package and features through to the framework is accomplished. This article offers resources for cash and you may advice which you should discover and can even use in the process of to order a house.

Finding Societal Safety Earnings (SSI) and Societal Coverage Disability (SSDI) dont prohibit you from to buy a home. Although not, there are several facts to consider. SSI beneficiaries keeps a cap for the possessions they have so you’re able to consistently receive SSI. The brand new cap was $dos,100000 for someone and you will $3,000 for a couple. Items that do not matter on cover – or funding restrict – include:

Very, overall, buying a house that have Public Security is not a problem, so long as you do not see sufficient assets otherwise assets to curb your capability to are eligible. This might are having to promote other qualities that you may very own, but never survive.

Resource Guide getting Homebuyers With Handicaps

For many who discover Societal Coverage Disability pros (SSDI), there is absolutely no house maximum, which means your qualification to continue acquiring experts would not be from inside the jeopardy. Although not, on account of earnings limits in order to maintain qualifications having SSDI gurus, you might not satisfy income requirements for some lenders. Discover, not, major home financing apps who do create and you will qualify those with SSI and you can SSDI gurus. These types of applications would-be browsed from the after the parts.

Home loan Software if you have Handicaps

Discover unique home loan programs set up if you have handicaps, or household members/caretakers/able-bodied people that accept or is actually buying a home to have you aren’t disabilities. For people who or even the person who you should buy the household for receives regulators handicap income, it is essential you remain updated info and you may documentation of the fresh SSI or SSDI. This may are often:

When your people getting the home is maybe not anyone choosing Social Protection benefits – a dad or sis to find a property to own a young child/cousin that have disabilities, as an example – make an effort to provide research the SSI/SSDI will continue for no less than 36 months. You can do this by significant hyperlink the confirming the newest recipient’s ages. The next applications could have personal requirements one disagree. This type of criteria will get hinge toward: