How to get a home loan for the 10 Actions and you can Land an excellent Brand new home

12 de noviembre de 20243 ways to invest in a tiny Household

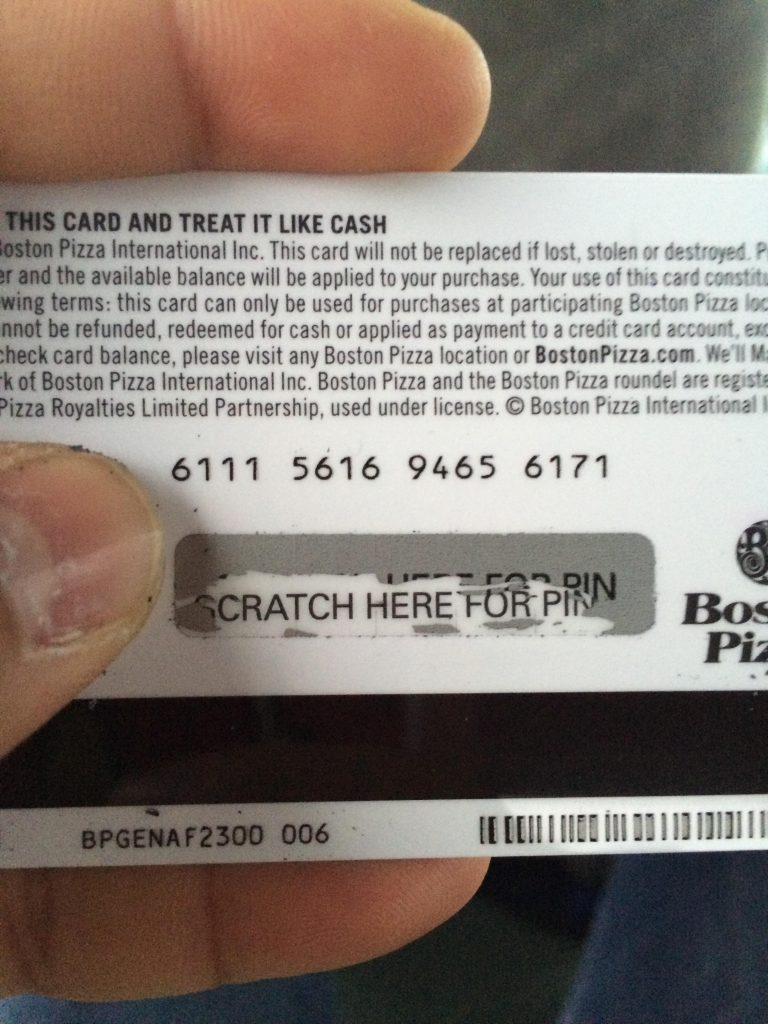

12 de noviembre de 2024If you use an enthusiastic FHA home loan to buy an excellent GNND domestic, you’re in a position to lay just $100 off. Johner Photo/Getty Photographs

- What’s the Good neighbor Next-door system?

- Benefits

- Qualification standards

- Ideas on how to apply

Affiliate backlinks with the facts on this page are from lovers one make up all of us (get a hold of the marketer revelation with this selection of couples for much more details). Yet not, all of our views was our own. Find out how i price mortgage loans to write unbiased evaluations.

- The nice Neighbor Across the street system lets qualified homebuyers get an effective HUD home at an effective fifty% discount.

- This choice is offered to cops, teachers, firefighters, and you can EMTs inside qualified revitalization parts.

- You must stay static in our home for a few ages – or even, you will have to pay back brand new discounted number.

To buy a property on good fifty% disregard may seem too good to be real. In fact, which is area of the need therefore not everyone that happen to be qualified to get a property from Good neighbor Across the street (GNND) program do therefore.

«Once we 600 dollar personal loans send out characters and you can leaflets and you can announcements toward the authorities organizations, flames departments, and college or university areas where this type of land are found, our very own biggest problem is somebody believe it is a scam,» claims Bruce Arrant, a home agent and you can founder of good Neighbor Nearby Realty. «‘Half-cost family? That is gotta end up being some type of scam.'»

What is the Good-neighbor Next-door program?

GNND try a program manage by the U.S. Service away from Construction and Metropolitan Invention (HUD). Permits police officers, teachers, firefighters, and you may crisis scientific technicians (EMTs) to acquire a property at the a good fifty% discount. When you use an enthusiastic FHA financial to order the home, you can also have the ability to put merely $100 off, as opposed to the common step three.5% down-payment.

Great things about the favorable Next-door neighbor Across the street program

Although just specific borrowers is also be eligible for GNND, the program has some advantages for those that use it. Listed here is a look at the Good neighbor Next door program experts:

Tall savings into the homes

The fresh savings on the Good-neighbor Nearby system may be the biggest pros, while they manage consumers high savings when selecting a house. They could save each other in advance (on your advance payment) as well as in the future (on your loan amount and you can monthly payment).

People revitalization

GNND facilitate rejuvenate the new groups it works in two-fold: first, because of the taking the brand new customers toward in earlier times foreclosed-into the belongings. Since the fresh citizens relocate, the new house usually are current, fixed, and you may remodeled, enhancing the complete top-notch the neighborhood.

As well, the program also brings public servants on these communities. This can trigger safe areas and higher instructional options for individuals who real time around.

Assistance getting public servants

At its heart, GNND is actually a community slave house dismiss program. It will help neighborhood professionals exactly who help customers everyday as a result of characteristics instance training otherwise taking disaster attributes or shelter. While the public servants normally have down salaries than others on the individual market, GNND will help offset that and give a reasonable street towards the homeownership.

Qualification standards

There are 2 groups of requirements for the GNND system – one towards borrower and one with the property. See less than having complete home elevators eligibility once and for all Neighbors 2nd Door.

Who qualifies?

To buy a half-priced home, you’ll want to works full-time in one of many occupations eligible for the new GNND system.

- The police officer: Need to be utilized by a federal, condition, regional, otherwise tribal government’s law enforcement company.